AQUAMORE : A leading private lender

Aquamore

How do I get a commercial property loan?

Founded in 2016, Aquamore is a boutique Sydney-based private loan lender. Our mission is to provide Australian Small and Medium Businesses with the best-secured business loan options available. Aquamore’s position as one of the leading private lenders in Australia allows us to act quickly. Indeed, we provide an exceptionally fast timeline from approval to loan disbursement. Contact us today to get started!

Kickstart Your Next Venture: Fast Business Loans from Aquamore

We pride ourselves on offering Australian businesses the opportunity to propel their growth through the quick business finance we provide. Are you at the stage of preparing to expand into new locations? Or are you looking to diversify your product offering and require a business loan to finance your research and development? Whatever your unique situation, the Aquamore team can provide leadership and support to help you realise your business goals.

Apply Now

How do I get a commercial property loan?

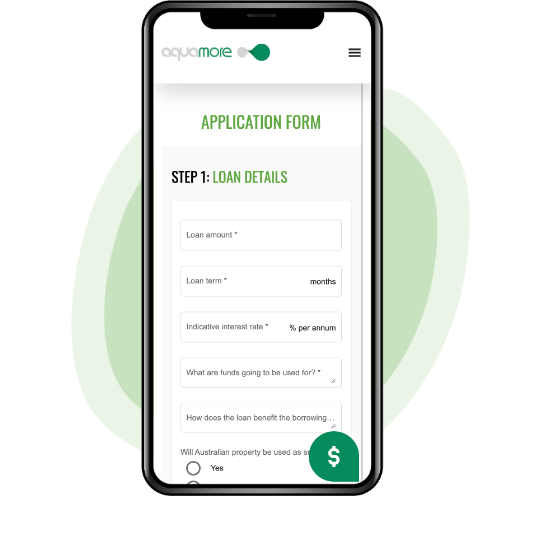

If you’re ready to pursue your commercial loan funding application, you can begin the process with our online commercial finance application form. Alternatively, if you’d like to discuss your individual circumstances with one of our Aquamore commercial loan experts, you can call or email us today.

Depending on your reasons for requiring capital to progress your business, there are several avenues you can explore to secure commercial finance. You may want to approach your bank to make an enquiry about funding. However, this can often have a long lead time and any speculative application is likely to require evidence of sound credit history. Depending on your industry, the status of your business and where in Australia you’re operating, there may be business grants available through government initiatives. Again, this option can be a lengthy process. In contrast, one of the most time-efficient options is to engage a property finance company like Aquamore. Upon loan approval, funds can be deposited to your account fast, giving you the freedom to focus on driving your business forward and preparing for the future.

Whether you’re looking to expand your entrepreneurial journey and require a bridge loan or you already operate an established business that requires an injection of funding, our secured business loans can offer several benefits. Firstly, they could help improve your credit rating and increase your likelihood of securing further future investment. At Aquamore, we’re experienced in supporting businesses that may not have a consistent credit history and can work with you to change this. Secondly, we offer fast business loans. As such, your business has the ability to respond to emerging market opportunities, thus cementing your position as a leader in your industry.

The right business loan provider for you depends on your specific circumstances. However, there are a number of key points to take into consideration such as the loan amount you require and the repayment terms. To discuss your individual requirements, you can call to talk to one of our expert advisors.

At Aquamore, we understand that short term property funding is time-critical. One of our unique market propositions is that we can offer a swift turnaround from application to releasing of funds in comparison to more traditional business loan companies and banks. Our expertise and investment knowledge mean we have our finger firmly on the pulse when it comes to the current economic climate. As such, we can leverage these insights to ensure the best possible loan terms for our clients.

If you’re ready to pursue your funding application, you can complete our online commercial finance application form to begin the process. Alternatively, if you’d like to discuss your individual circumstances with one of our Aquamore loan experts, you can call or email us today.